Bitcoin, AI, and Housing - The Unexpected Connections You Need to Know

Bitcoin, AI, and Housing - The Unexpected Connections You Need to Know

By Mike Abbate, Chief Investment Officer, and Jesse Yuan, Senior Research Analyst

July 2, 2024

Key Takeaways

- Bitcoin selling pressure overstated

Over the last two weeks, the price of bitcoin, along with the tech heavy NASDAQ composite, declined after Federal Reserve officials signaled to the market that they anticipate only one interest-rate cut for the remainder of the year.

- Convergence of AI and Bitcoin

As the interest in AI remains at fever pitch, we call attention to the less advertised dilemma for the AI industry; where to plug in the computers to train the AI models. The AI industry has much to learn from the bitcoin mining industry in this respect and we see an eventual alignment of the two technologies.

- Housing prices hit all-time highs

The housing market is experiencing unprecedented price increases1 due to a severe supply-demand imbalance which we expect to continue. Scarcity is a common thread that runs between the US housing market and the crypto market worth highlighting.

Bitcoin selling pressure overstated

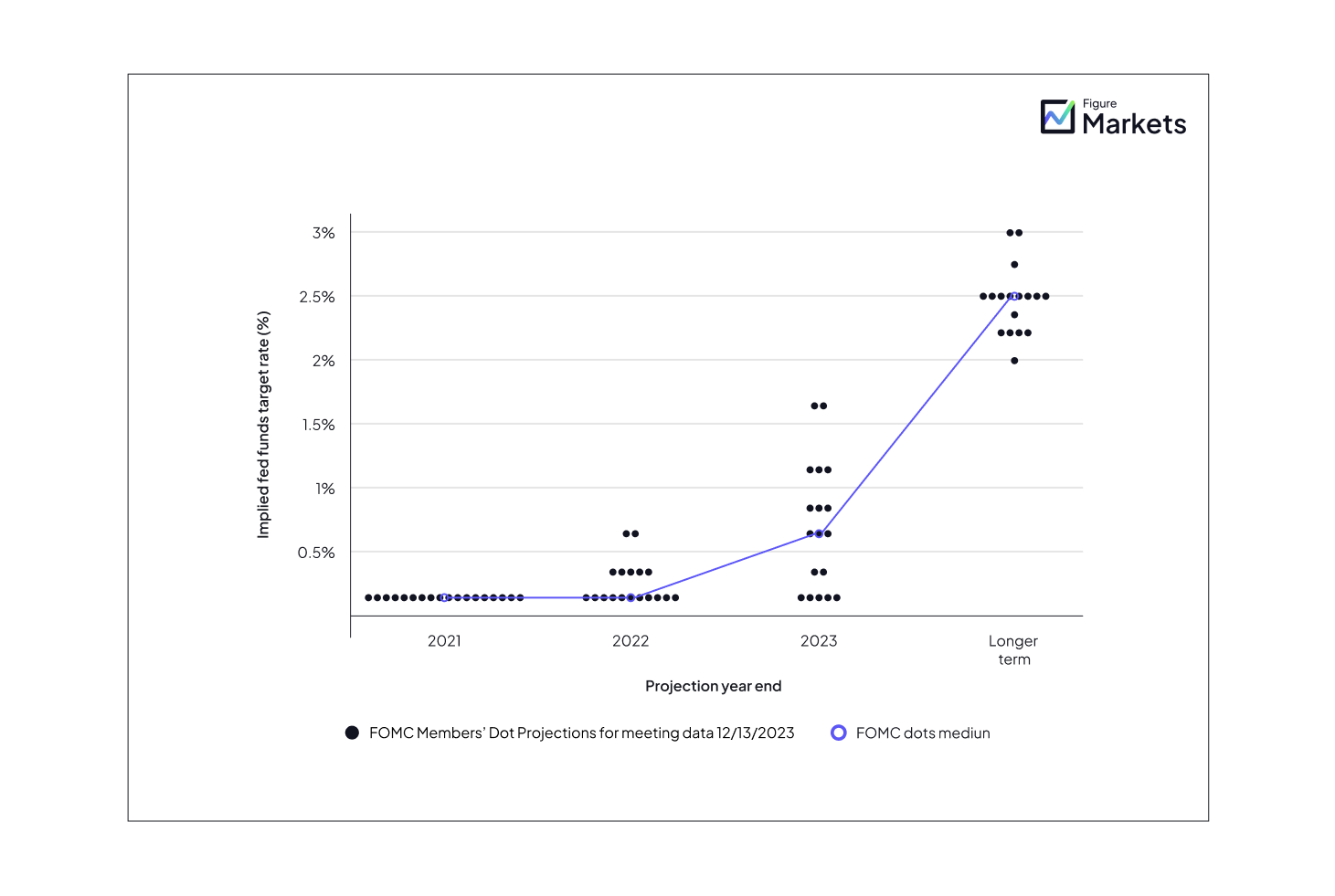

Although it is difficult to point to any single catalyst for the selling pressure for bitcoin, we highlight two. The first being the obvious jawboning from Fed officials after their June meeting to walk back rate cuts later this year. Given the Feds historical performance, we do not give much credence to any of their projections. Below is the chart from three years ago, with their prediction for rates in 2024. As Lloyd Christmas once said, “I was way off.”

Exhibit 1: Implied Fed Funds Target Rate as of June 20212

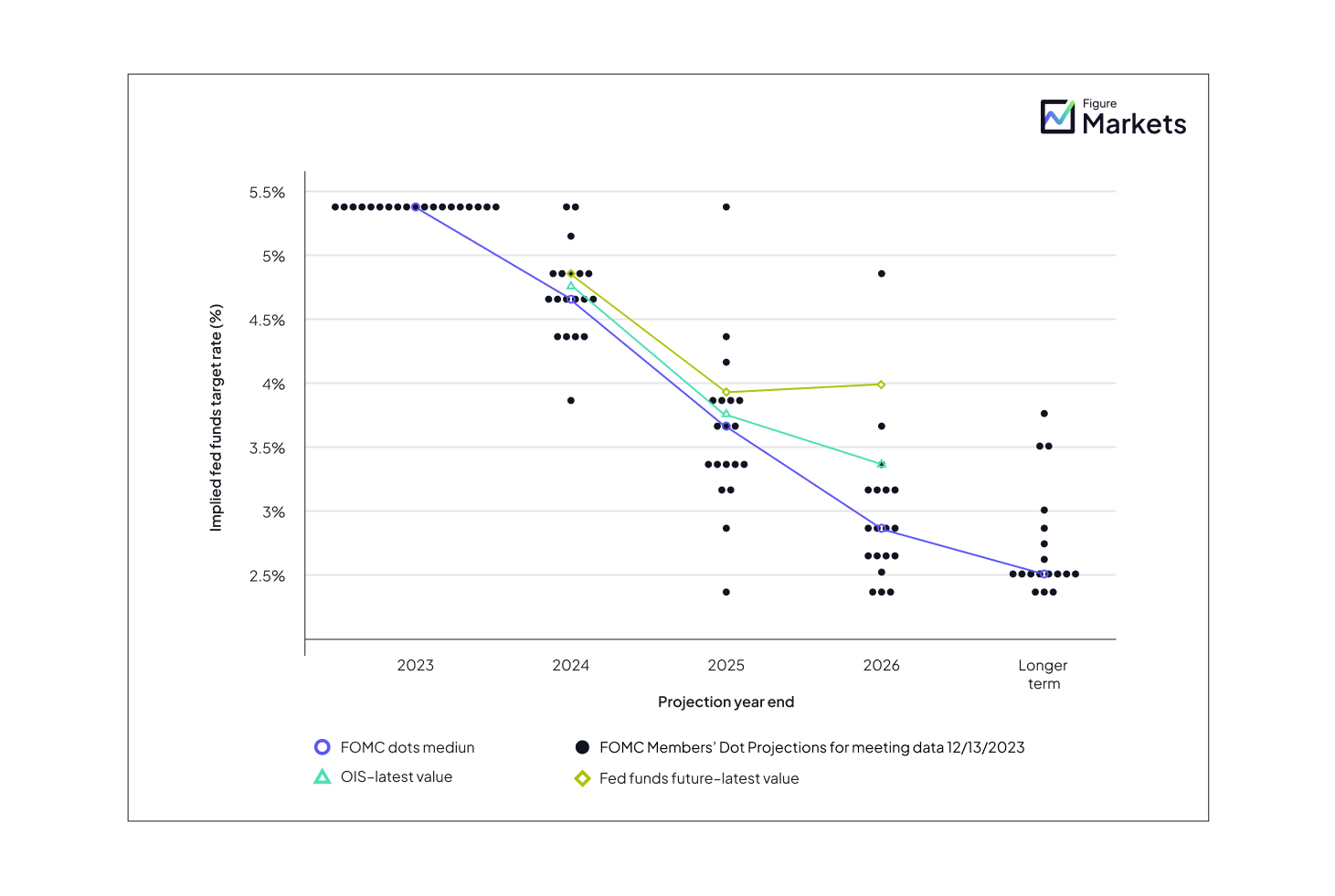

Exhibit 2: Implied Fed Funds Target Rate as of December 20233

Second, after years of shifting deadlines, Mt. Gox, a former bitcoin exchange based in Tokyo, announced on June 24, 2024, that it would begin repayments to creditors starting in July, 2024. Bitcoin prices immediately dropped due to anticipated selling pressure following the repayments. Although it is unclear how much Mt. Gox will distribute to customers, Mt. Gox transferred around 142,000 bitcoin (or ~$8.8bn4) to an unknown wallet last week, possibly as part of the plan to repay creditors. We expect many of the creditors will likely monetize their repayments since their bitcoin was acquired at a relatively low cost basis (bitcoin was priced ~$3005 at the end of 2014). We believe selling pressure may be overstated though - assuming all of the transferred $8.8bn bitcoin is monetized, it only represents <1% of total monthly trading volumes. Some rough math based on trading statistics from May:

Exhibit 3: Bitcoin May Trading Volume6

| Instrument | 5/24 Trading Volumes |

|---|---|

| BTC perps & futures | $1.53tn |

| BTC options | $50.2bn |

| BTC spot | $41bn7 |

| BTC ETF | $250mm |

| Total | $1.62tn |

Conclusion: even if all $8.8bn of bitcoin is sold, the selling pressure is a drop in a bucket given the global liquidity of bitcoin.

Going beyond disproving bearish technicals, it is worth highlighting the bullish ones. Historically, supply and demand mechanics are favorable following halving events, which we just experienced in April. Bitcoin prices experienced significant run ups of approximately 10x, 2x, and 7x in each of the last three halvings8.

Meanwhile, VanEck’s filing on June 27, 2024 to sell shares in a SOL ETF resulted in an immediate surge in the price of SOL, rising from $136 to a peak of $149. However, we are skeptical of approval under the current administration due to the SEC's stance that SOL is a security in its complaint against Binance last year.

Convergence of AI and Bitcoin

What do AI models and Bitcoin miners have in common? More than most people realize. Both rely heavily on data centers, which require two basic commodities: computer chips and electricity. Globally, the number of data centers has surged to over 7,000, up from 3,600 in 20159. This trend has caused expectations of power demand in the US to grow by 40% over the next two decades, compared to just 9% growth over the past 20 years10.

Ideally, data centers are located near low-cost, renewable energy sources. However, the cheapest electricity is typically located in remote areas, making it less than ideal for more traditional data centers due to latency concerns. Additionally, the lowest-cost, baseload sources of energy cannot not be easily turned on or off which does not deal well with fluctuating demand. Finally, renewable energy tends to be intermittent; the sun does not always shine, the wind does not always blow.

Bitcoin miners have had to deal with these issues and have done so successfully by employing demand response programs: mining when energy demand is low and shutting down when demand is high. The added benefit is this load balancing uses otherwise wasted energy and helps stabilize energy grids.

AI providers are facing the same difficulties and finding great value in partnering with bitcoin miners to leverage their infrastructure and expertise. Many pure-play Bitcoin miners are expanding into or partnering with high-power compute service providers. For example, Core Scientific signed a 12-year, $3.5bn contract to procure over 270 MW of power dedicated to AI training with CoreWeave. Hut 8 received a $150mm investment from Coatue to develop next-generation AI infrastructure. We believe this trend will continue, with renewable data centers and baseload generators paired with AI training and Bitcoin mining operations, optimizing energy use by training or mining when power prices are low and supplying power to the grid when prices are high.

Housing prices hit all time high

"Buy land, they are not making any more of it" - Mark Twain

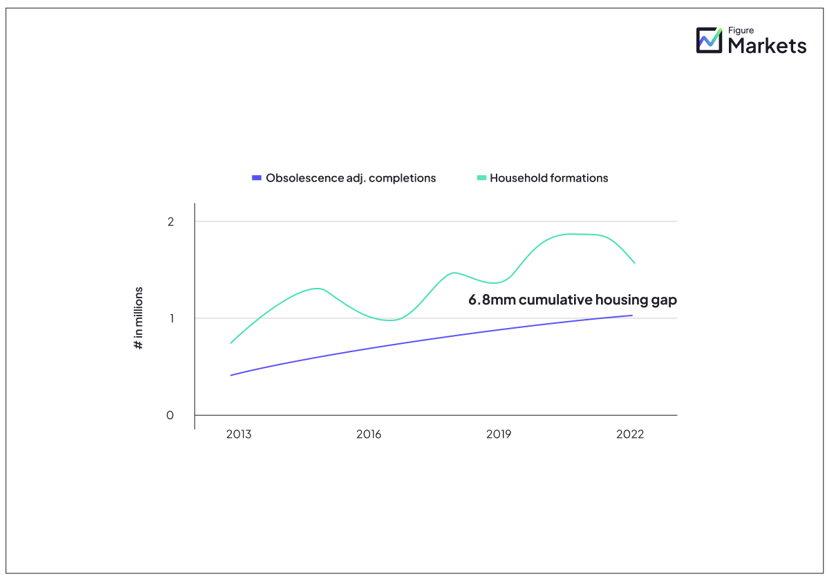

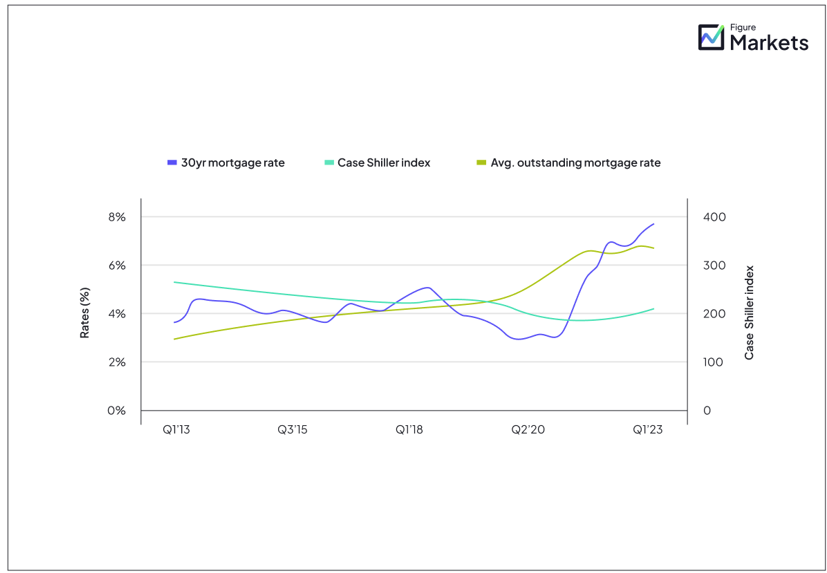

The National Association of Realtors reported in May that median housing prices reached its all-time highs in the face of the highest rates in 25 years. How could this be? The answer is simple: supply and demand. In the US, there is a cumulative housing gap of ~6.8mm homes and homeowner mobility is at all-time lows due to relatively low-rates on existing mortgages coupled with concurrent rise in aforementioned financing costs.

Exhibit 4: Housing Supply and Demand Mismatch11

Exhibit 5: Low Homeowner Mobility12

We are constantly looking for the common themes that tie real assets to digitally native assets on decentralized blockchains: scarcity is one of our favorites. We believe the same type of investor that invests in bitcoin as a store of value would also invest in US real estate.